Fibonacci Trading with Extensions

Introduction

Fibonacci trading is a popular technical analysis tool used by traders to identify potential price levels and market trends. The Fibonacci sequence is a series of numbers in which each number is the sum of the two preceding ones. Fibonacci extensions, on the other hand, are levels beyond the standard Fibonacci retracement levels that traders use to anticipate future price movements. In this article, we will explore how to use Fibonacci extensions in your trading strategy.

Understanding Fibonacci Extensions

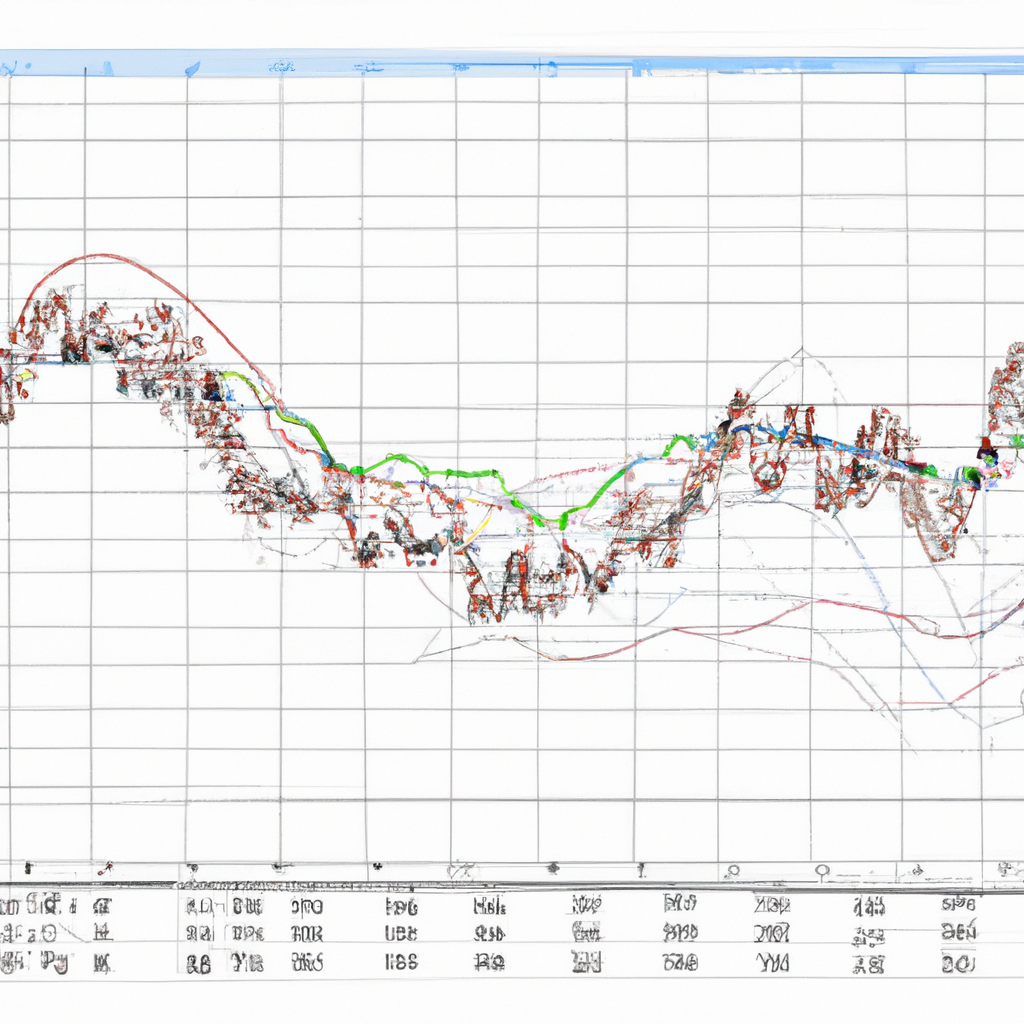

Fibonacci extensions are calculated by extending the Fibonacci retracement levels beyond 100%. These levels are potential areas where price may reverse or continue its trend. The most commonly used Fibonacci extension levels are 127.2%, 161.8%, and 261.8%. Traders often use these extensions to identify profit targets or potential reversal zones.

Identifying Fibonacci Extensions

To identify Fibonacci extensions, you first need to identify a significant price swing or trend. This can be done by drawing Fibonacci retracement levels from the swing low to the swing high (in an uptrend) or from the swing high to the swing low (in a downtrend). Once you have identified the swing points, you can extend the Fibonacci levels beyond 100% to identify potential extension levels.

Using Fibonacci Extensions in Trading

Fibonacci extensions can be used in various ways in your trading strategy. Here are a few common approaches:

1.

Profit Targets

When a price is trending, Fibonacci extensions can be used to identify potential profit targets. Traders often set their profit targets at the 127.2% or 161.8% extension levels. These levels can act as resistance or support, causing the price to reverse or consolidate.

2.

Reversal Zones

Fibonacci extensions can also be used to identify potential reversal zones. When the price reaches a Fibonacci extension level, it may reverse its trend. Traders often look for other technical indicators or price action confirmation to validate the potential reversal.

3.

Entry and Exit Points

Fibonacci extensions can be used in conjunction with other technical analysis tools to identify entry and exit points. For example, if the price is in an uptrend and reaches a Fibonacci extension level, traders may look for a bullish signal to enter a long position. Conversely, if the price is in a downtrend and reaches a Fibonacci extension level, traders may look for a bearish signal to exit a short position.

Conclusion

Fibonacci extensions are a valuable tool for traders to identify potential price levels and market trends. By understanding and using Fibonacci extensions in your trading strategy, you can improve your decision-making process and increase your chances of successful trades. Remember to always combine Fibonacci extensions with other technical analysis tools and market indicators for a comprehensive trading approach.