Oscillators and Momentum Indicators: A Guide to Understanding and Using Them

Introduction

Oscillators and momentum indicators are key tools in technical analysis that help traders and investors identify potential market trends and reversals. By analyzing price movements and comparing them to historical data, these indicators provide valuable insights into the strength and momentum of a particular asset or market. In this article, we will explore the concept of oscillators and momentum indicators, their significance, and how to effectively use them in your trading strategy.

What are Oscillators?

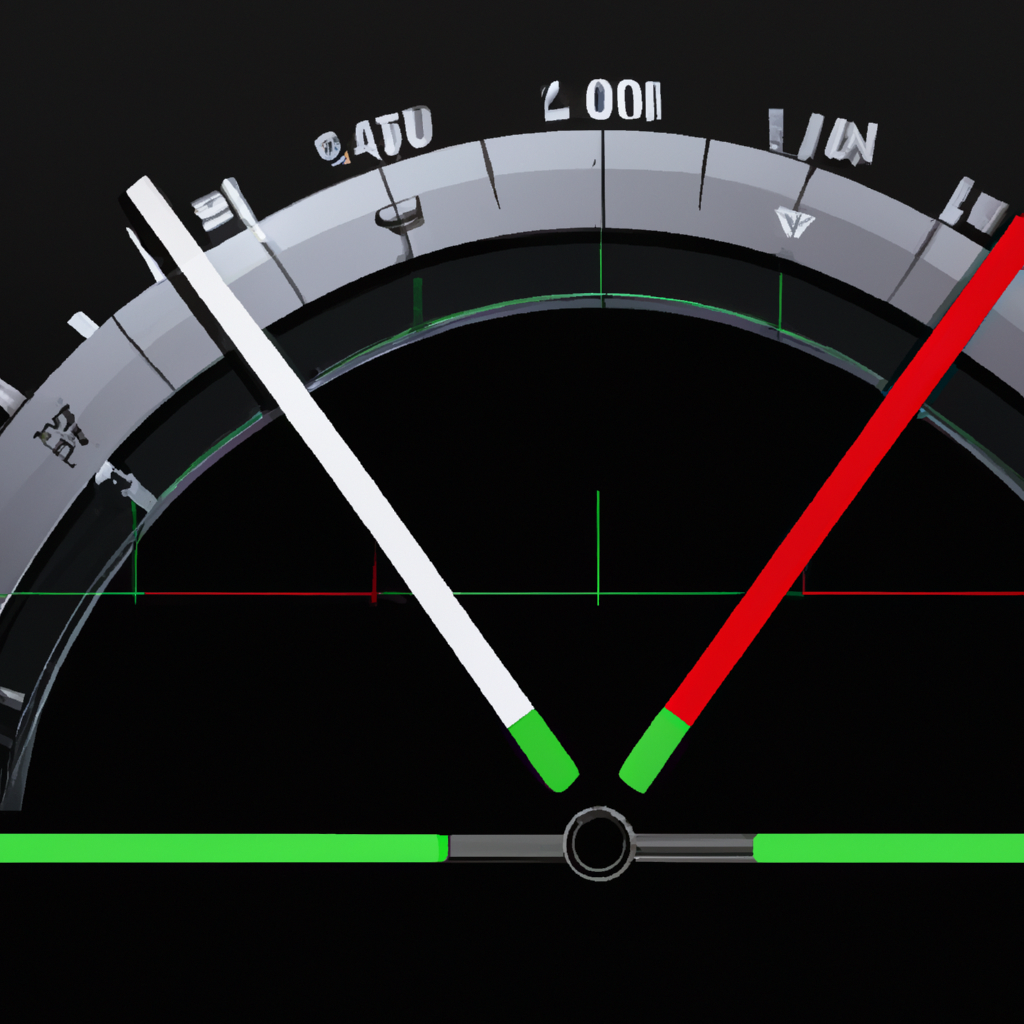

Oscillators are technical indicators that measure the speed and magnitude of price movements within a given time frame. They are typically displayed as lines or histograms below the price chart and oscillate between predefined upper and lower boundaries. Oscillators help traders identify overbought and oversold conditions, potential trend reversals, and divergence between price and momentum.

Types of Oscillators

There are various types of oscillators available, each with its own calculation methodology and interpretation. Some commonly used oscillators include:

- Relative Strength Index (RSI): Measures the speed and change of price movements to indicate overbought or oversold conditions.

- Stochastic Oscillator: Compares the closing price of an asset to its price range over a specific period, highlighting potential reversal points.

- Moving Average Convergence Divergence (MACD): Consists of two lines that track the relationship between two moving averages, indicating bullish or bearish market conditions.

- Williams %R: Measures overbought and oversold levels by comparing the closing price to the highest high and lowest low over a specific period.

Understanding Momentum Indicators

Momentum indicators, as the name suggests, are used to gauge the strength and velocity of price movements. They help traders identify potential trend reversals, confirm the strength of an ongoing trend, and spot divergence between price and momentum, which can signal a potential market shift.

Types of Momentum Indicators

Similar to oscillators, momentum indicators come in various forms, each providing unique insights into market dynamics. Some popular momentum indicators include:

- Moving Average Convergence Divergence (MACD): As mentioned earlier, MACD can also be classified as a momentum indicator due to its ability to identify the strength and direction of a trend.

- Relative Strength Index (RSI): While RSI is primarily an oscillator, it can also be used as a momentum indicator to assess the velocity of price movements.

- Rate of Change (ROC): Measures the percentage change in price over a specific period, helping traders identify the speed of price movements.

- Average Directional Index (ADX): Indicates the strength of a trend by measuring the positive and negative directional movements.

Using Oscillators and Momentum Indicators Effectively

Here are a few tips to consider when using oscillators and momentum indicators in your trading strategy:

- Understand the indicator’s interpretation: Study the calculation methodology and the interpretation guidelines for each oscillator or momentum indicator you plan to use.

- Combine indicators for confirmation: Consider using multiple indicators to confirm signals and avoid relying on a single indicator for decision-making.

- Consider the market context: Analyze the broader market conditions and trends before relying solely on oscillator or momentum indicator signals.

- Use in conjunction with other technical analysis tools: Combine oscillators and momentum indicators with other tools like trend lines, support and resistance levels, and candlestick patterns for a comprehensive analysis.

- Practice and backtest: Before using these indicators in live trading, practice and backtest your strategy using historical data to gain confidence and assess its effectiveness.

Conclusion

Oscillators and momentum indicators are valuable tools for traders and investors seeking to understand market dynamics and make informed trading decisions. By incorporating these indicators into your technical analysis toolkit and following the best practices outlined in this article, you can enhance your ability to identify potential trends, reversals, and divergence, ultimately improving your trading outcomes.