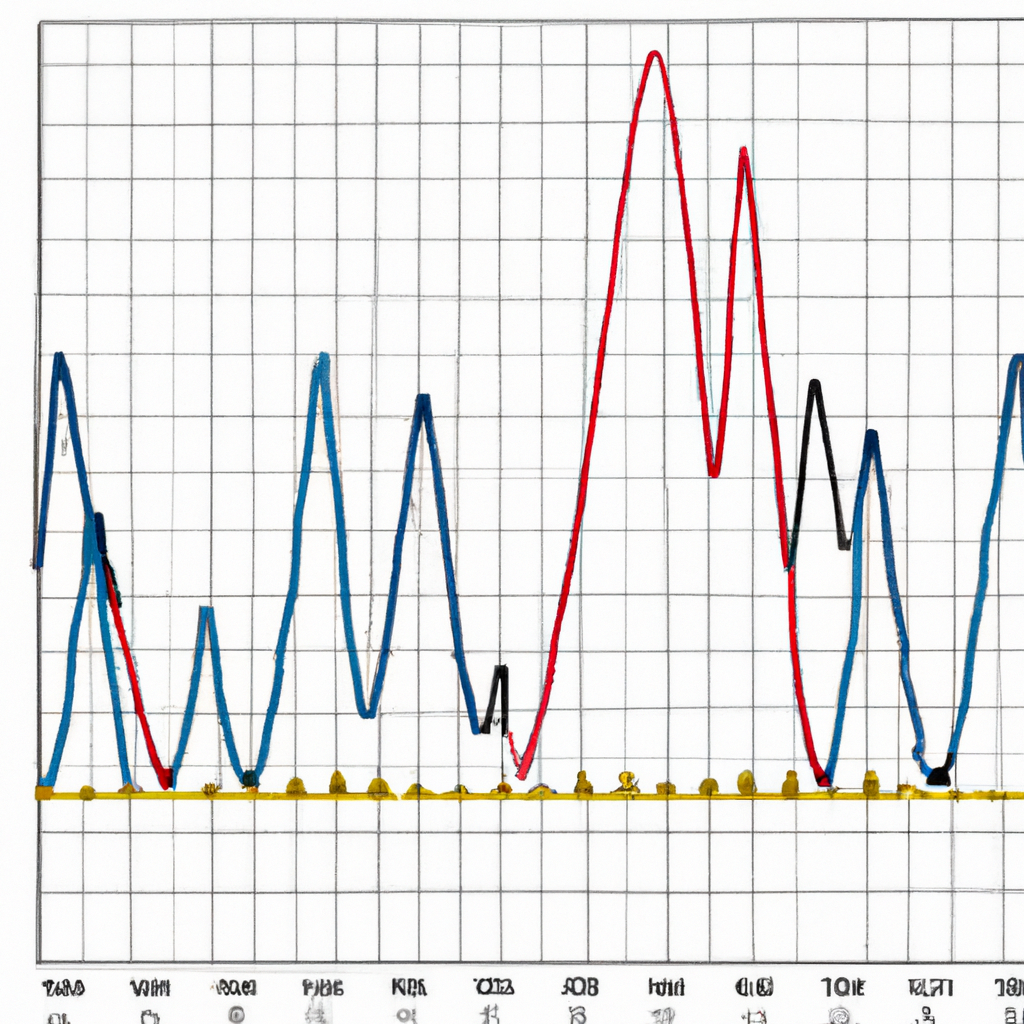

MACD Histogram Interpretations

MACD (Moving Average Convergence Divergence) is a popular technical analysis indicator used by traders to identify potential buy and sell signals in financial markets. The MACD histogram, a visual representation of the MACD indicator, provides valuable insights into market trends and momentum. In this article, we will explore the different interpretations of the MACD histogram and how traders can use it to make informed trading decisions.

Understanding MACD Histogram

Before delving into the interpretations, let’s briefly discuss the MACD histogram and how it is calculated. The MACD histogram is derived from the MACD line and the signal line. The MACD line is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA, while the signal line is a 9-day EMA of the MACD line. The histogram is then obtained by subtracting the signal line from the MACD line.

Interpretations of MACD Histogram

1. Positive Histogram: When the MACD histogram bars are above the zero line, it indicates that the MACD line is above the signal line, suggesting bullish momentum in the market. The taller and wider the bars, the stronger the bullish momentum. Traders often view this as a buying opportunity or a signal to hold onto existing long positions.

2. Negative Histogram: Conversely, when the MACD histogram bars are below the zero line, it indicates that the MACD line is below the signal line, indicating bearish momentum. The height and width of the bars represent the strength of the bearish momentum. Traders may consider this as a signal to sell or take short positions.

3. Divergence: Divergence occurs when the price of the asset and the MACD histogram move in opposite directions. Bullish divergence happens when the price makes lower lows while the MACD histogram forms higher lows. This suggests a potential trend reversal and a buying opportunity. On the other hand, bearish divergence occurs when the price makes higher highs while the MACD histogram forms lower highs, indicating a potential trend reversal to the downside.

4. Convergence: Convergence refers to the situation when the price and the MACD histogram move in the same direction. When the price is making higher highs and the MACD histogram also forms higher highs, it confirms the uptrend. Similarly, if the price is making lower lows and the MACD histogram also forms lower lows, it confirms the downtrend.

Using MACD Histogram for Trading Decisions

Traders can utilize the MACD histogram in various ways to make trading decisions:

- Crossing the Zero Line: When the MACD histogram crosses above the zero line, it generates a buy signal, indicating a shift from bearish to bullish momentum. Conversely, when the histogram crosses below the zero line, it generates a sell signal, indicating a shift from bullish to bearish momentum.

- Signal Line Crossovers: Traders also pay attention to the crossovers between the MACD histogram and the signal line. When the histogram crosses above the signal line, it generates a bullish signal, and when it crosses below the signal line, it generates a bearish signal.

- Confirmation with Price Patterns: Traders often combine the MACD histogram with other technical analysis tools, such as support and resistance levels or chart patterns, to confirm their trading decisions. For example, if the MACD histogram shows a bullish signal while the price breaks above a key resistance level, it strengthens the buying signal.

It is important to note that the MACD histogram is not foolproof and should be used in conjunction with other indicators and analysis techniques to increase the probability of successful trades. Traders should also consider the overall market conditions and risk management strategies when interpreting the MACD histogram.

Conclusion

The MACD histogram is a valuable tool for traders to gauge market trends and momentum. By understanding the interpretations of the MACD histogram and combining it with other technical analysis tools, traders can make more informed trading decisions. However, it is essential to practice risk management and consider the limitations of any single indicator when using the MACD histogram or any other technical analysis tool.