Introduction to Fibonacci Extensions in Trading

Fibonacci extensions are a tool used by traders to predict potential price targets or take-profit levels in the financial markets. Based on the Fibonacci sequence, these extensions go beyond the standard Fibonacci retracement levels to provide insight into where the price of an asset may head after an initial movement. Understanding how to use Fibonacci extensions can give traders an edge in timing their trades and managing their risk.

Understanding the Fibonacci Sequence

Before diving into Fibonacci extensions, it’s crucial to comprehend the underlying Fibonacci sequence. This sequence starts with 0 and 1, and each subsequent number is the sum of the two preceding ones. In trading, the key ratios derived from this sequence are 23.6%, 38.2%, 50%, 61.8%, and 100%, which are used in Fibonacci retracement levels. For extensions, traders use ratios beyond 100%, including 161.8%, 261.8%, and 423.6%, to forecast potential future price movements.

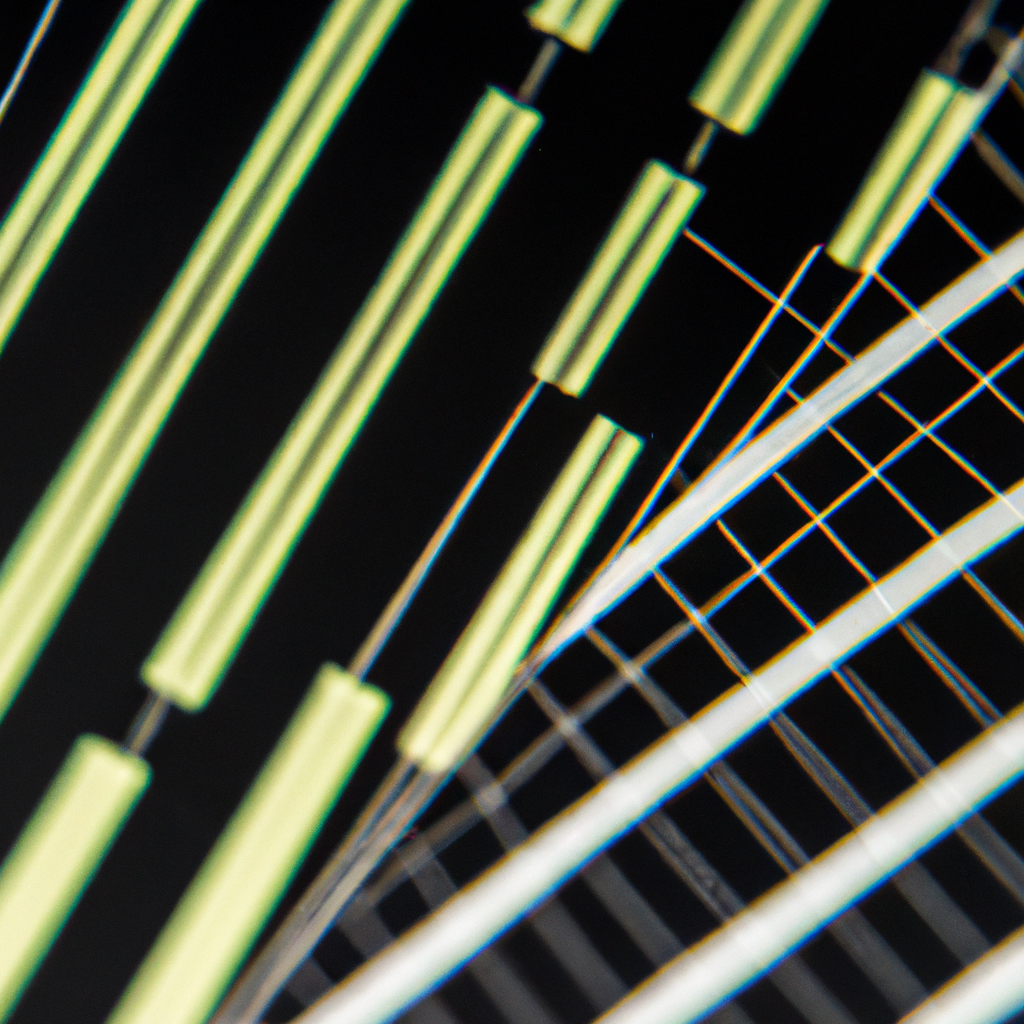

How to Draw Fibonacci Extensions

Drawing Fibonacci extensions requires three points on a chart, unlike Fibonacci retracements which only need two. Here’s how to do it:

Step 1: Identify the Swing High and Swing Low

First, you need to spot a significant price movement, identifying the swing high (peak) and swing low (trough) points. This movement can be either upward or downward, depending on the trend you’re analyzing.

Step 2: Select the Fibonacci Extension Tool

Most trading platforms come with a Fibonacci tool. After selecting the Fibonacci extension tool, start at the swing low and drag it to the swing high for uptrends. For downtrends, do the opposite.

Step 3: Set the Third Point

Once you’ve connected the swing high and low, the next step is to set the third point. This point is typically at the retracement level where the pullback ends, and the price resumes moving in the original trend direction.

Interpreting Fibonacci Extensions

Fibonacci extensions can help predict where the price might find support or resistance in the future. These levels become potential targets for taking profit or closing positions. For instance, if a price moves beyond a 100% extension level, traders might look to the 161.8% level as the next possible area where the price could stall or reverse.

Applications and Limitations

While Fibonacci extensions are a valuable tool for forecasting, they should not be used in isolation. Consider integrating them with other technical indicators and analysis methods to verify signals. It’s also important to remember that, like all trading tools, Fibonacci extensions offer probabilities, not certainties. Therefore, applying proper risk management techniques is crucial to safeguard your trades against unexpected market movements.

Conclusion

Fibonacci extensions provide traders with a roadmap of potential price targets beyond the standard retracements, helping in decision-making for entry and exit points. By mastering Fibonacci extensions, traders can enhance their trading strategy, achieving better predictability and consistency in their trading outcomes. However, it’s essential to use them wisely, in conjunction with a comprehensive trading plan and sound risk management practices.